- 📰 TOP OIL & GAS HEADLINES

- https://oilprice.com/Energy/Crude-Oil/Trump-Emergency-Order-Accelerates-Oil-and-Gas-Permitting.html

- https://www.khaleejtimes.com/business/oil-prices-fall-3-sources-say-opec-to-consider-accelerating-oil-output

- Oil rebounds after 2pc drop on Opec+ output rise

- Crude Falls Despite Trade Talk Optimism

- BP shares whipsaw as activist investor Elliott discloses stake build

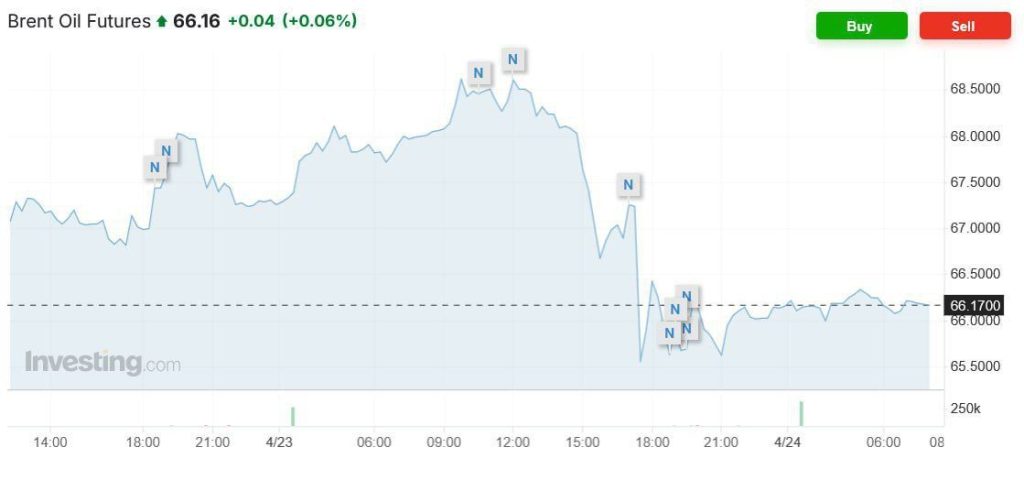

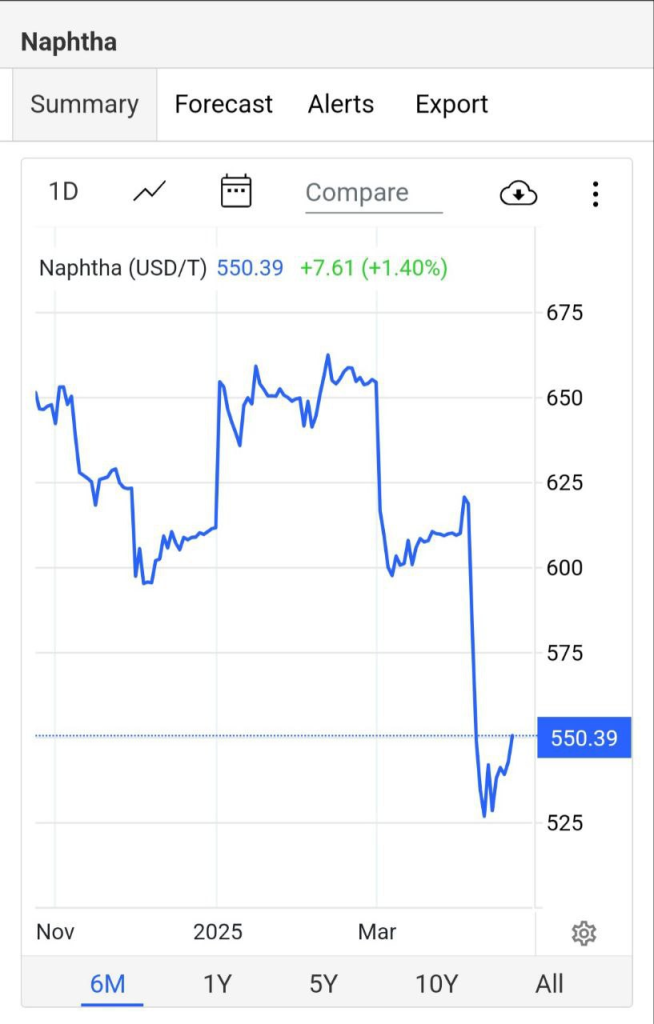

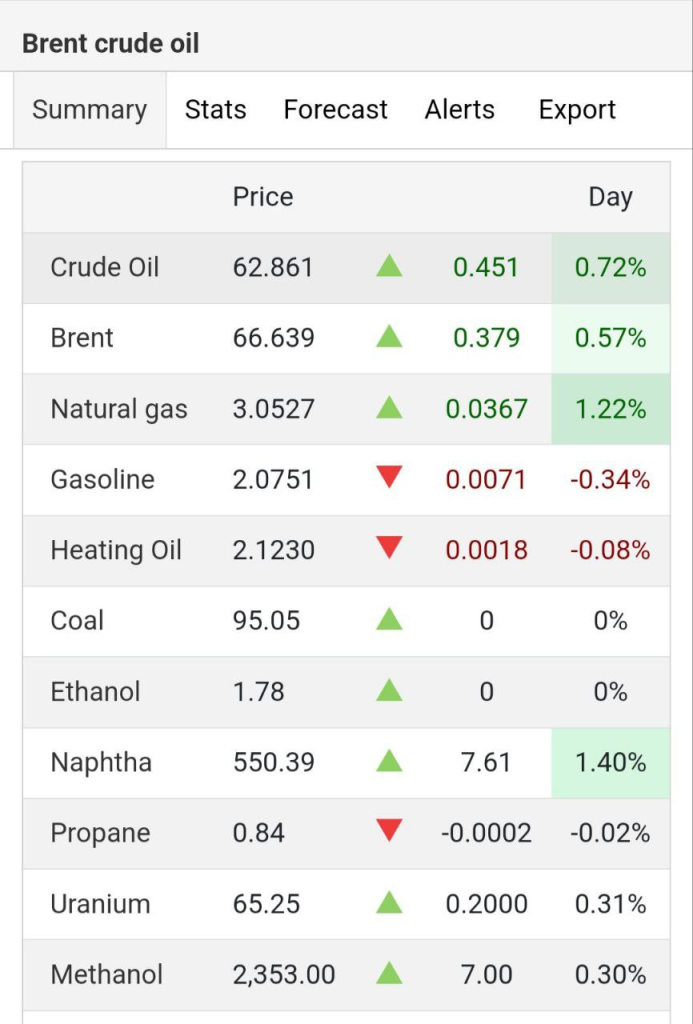

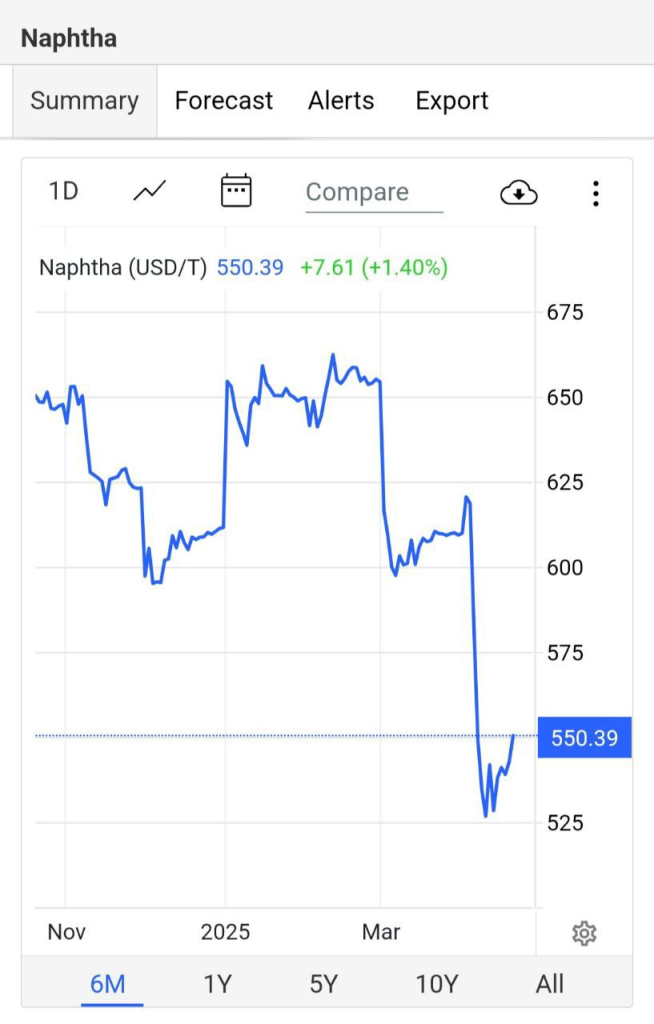

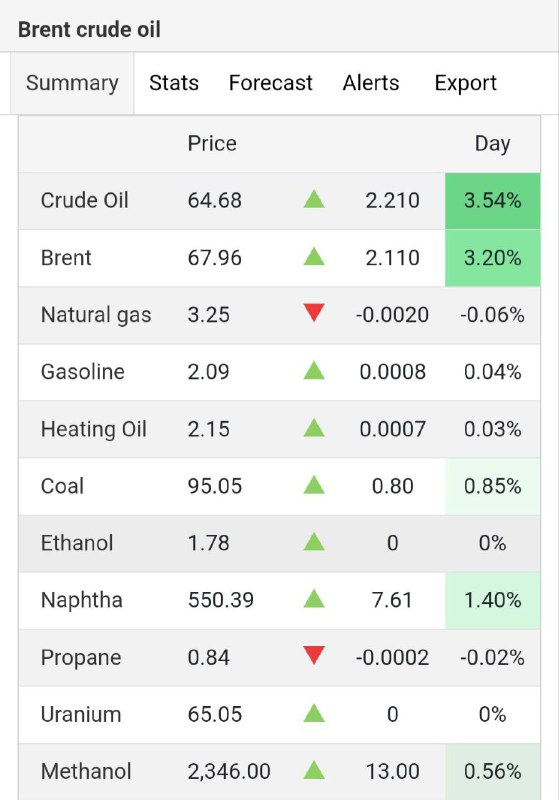

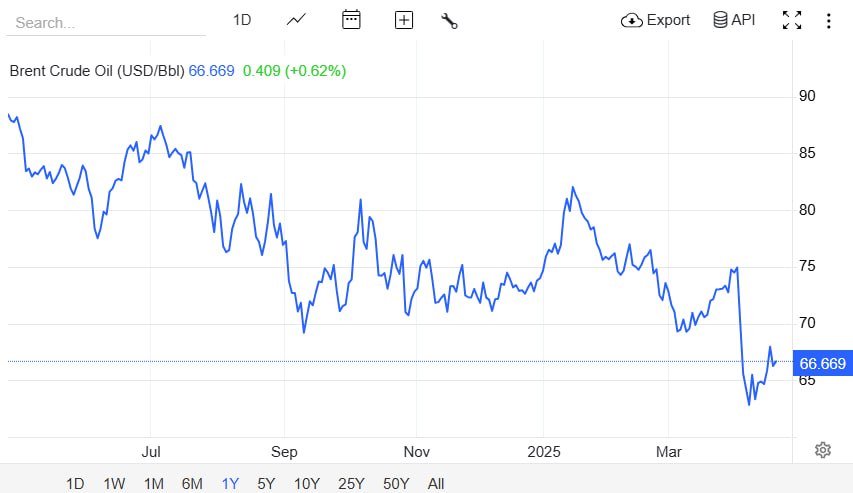

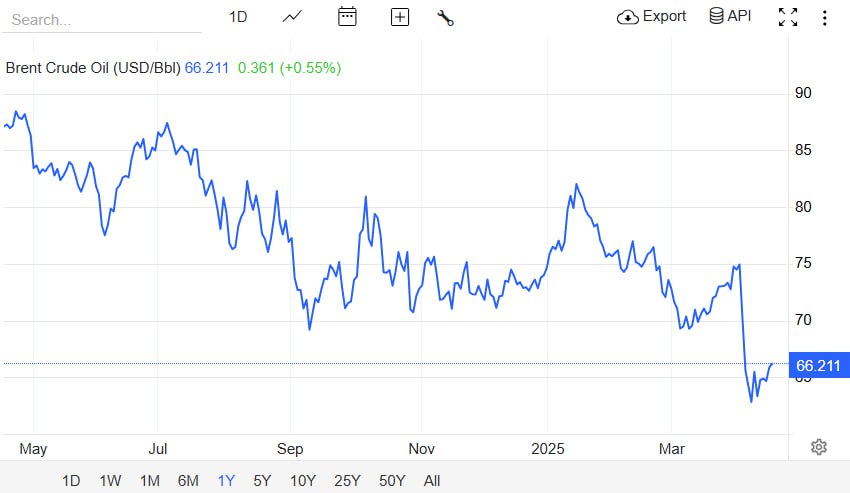

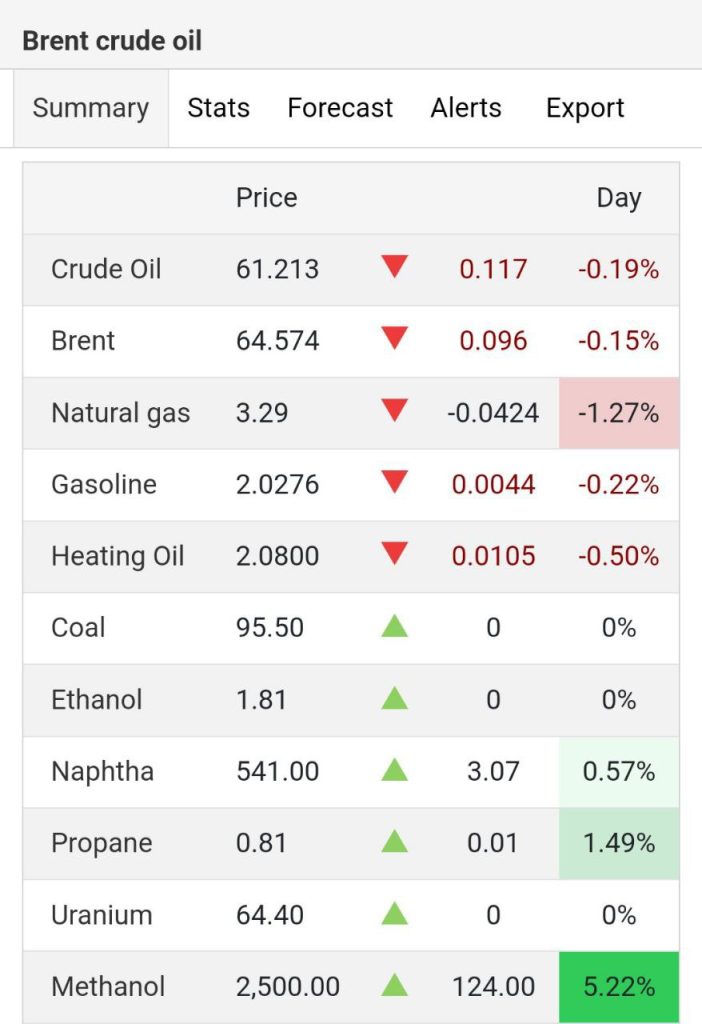

Brent Trading Continues at $66 Brent, which had approached $68 yesterday, ended the market at $66. Today’s trading in global markets also began at $66. #Oil_Price Current price of Brent: $66.16 U.S. oil: $62.32

🛢Sinopec has resumed oil purchases from Russia.

🔸Trade sources reported that Sinopec of China has once again started purchasing oil from Russia.

🔸These sources also reported that the number of shipments purchased by Unipec is significantly lower compared to before the announcement of sanctions in January.

🔸Reuters reported last month that sanctions led to a decrease in Russian oil exports to China and India, and state-owned oil companies in China like Sinopec and Zhenhua Oil suspended oil purchases from Russia.

🔸Traders noted that Russian ESPO crude oil cargoes for loading in May were traded at a risk premium of about $2 per barrel compared to cargoes of North Sea Brent crude received by China.

🆔 https://t.me/sdtoman

- 📰 TOP OIL & GAS HEADLINES

- Abu Dhabi Ports completes first ship-to-ship LNG bunkering operation at Khalifa

- ENERGY LEADERS EXPOSE ‘FLAWS’ IN GLOBAL TRANSITION RACE

- China Turns to Middle East LPG to Replace Tariff-Hit US Gas

- ADNOC Launches App to Boost UAE Manufacturing

- India, Saudi Arabia agree to boost cooperation in energy and defence

- Oil up more than 1% on fresh Iran sanctions, lower US crude stocks

- Woodside Energy Warns Tariffs Could Impact Louisiana LNG Project

- 5 European stocks to watch this earnings season as Trump’s tariffs hit

- 📰 TOP OIL & GAS HEADLINES

- Oil Prices Stabilize on Short-Covering and an OPEC+ Output Decline

- HSBC trims Brent crude oil price forecasts for 2025 and 2026

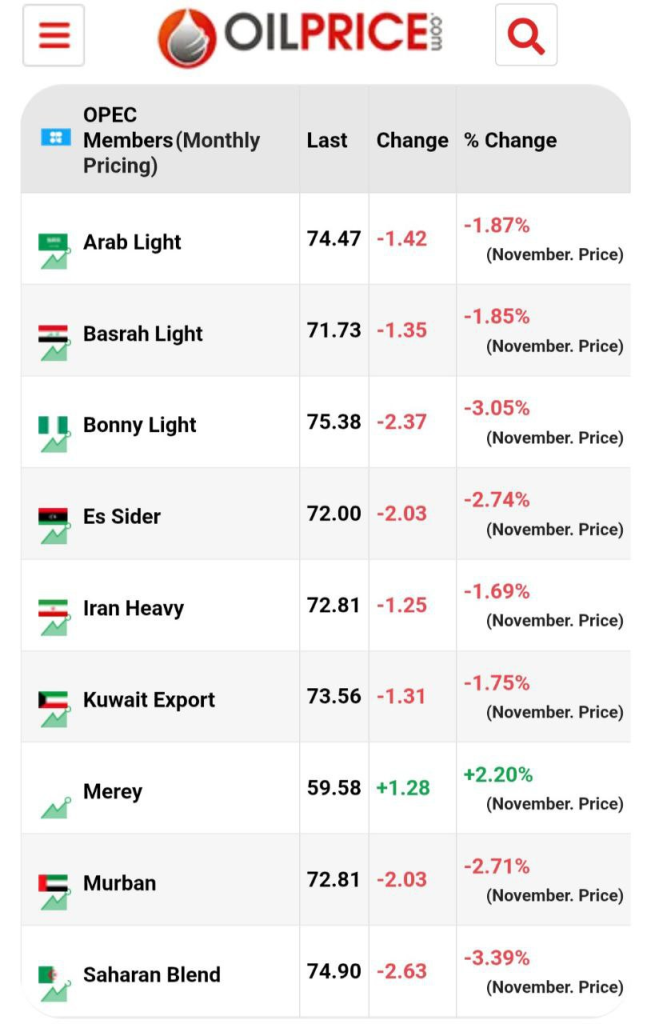

- OPEC cuts oil demand forecast, sees growing economic uncertainty on Trump trade

- Sharp drop in global crude oil prices drags down Canadian energy stocks

- China halts U.S. LNG imports as tariffs escalate, data shows

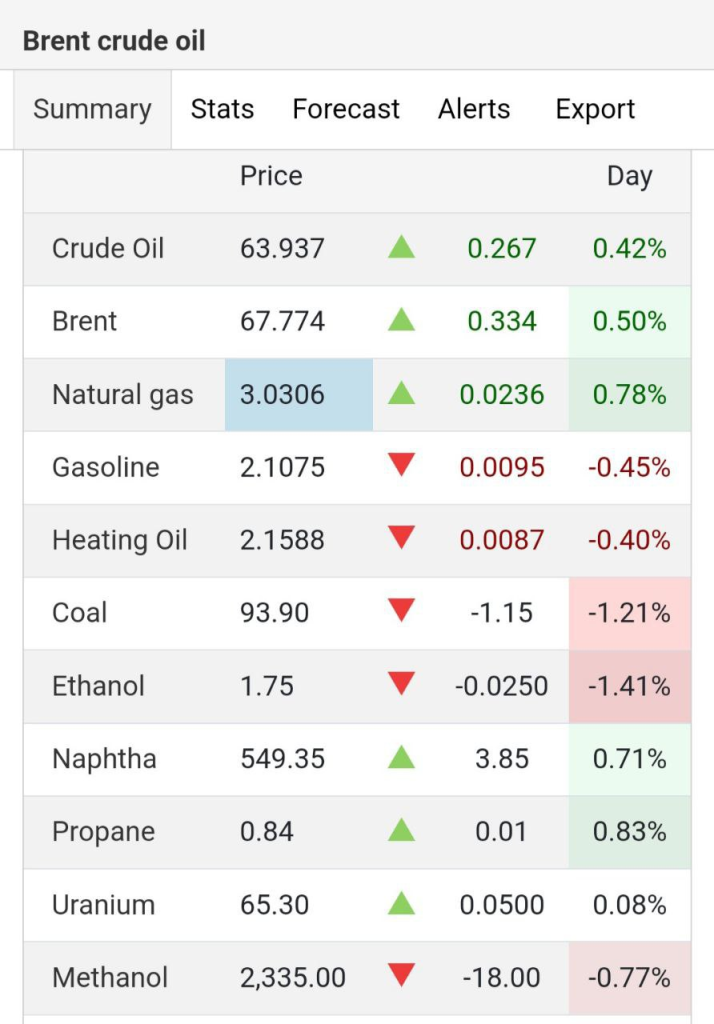

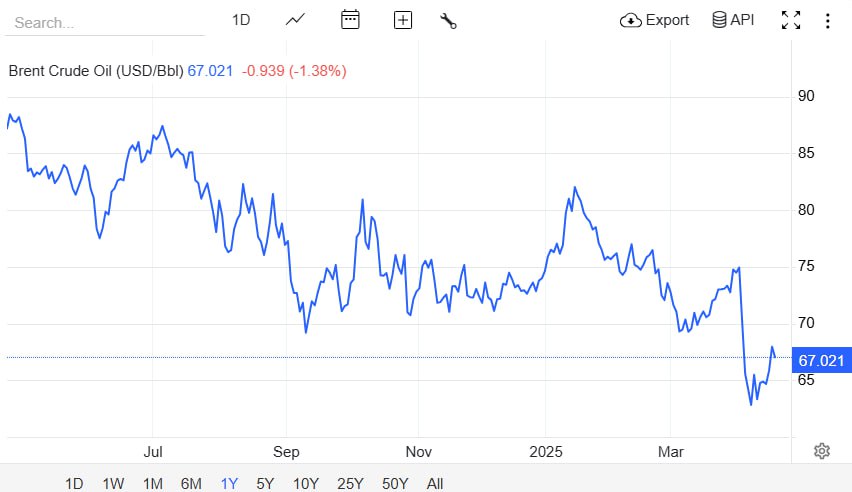

Brent crude futures fell by more than 1 percent on Monday, reaching around $67 per barrel, as progress in nuclear negotiations between the United States and Iran eased concerns about potential supply constraints. Iran’s foreign minister stated that the two countries agreed on Saturday to begin drafting a framework for a potential nuclear deal. An American official also described the discussions as ‘very good progress.’ This followed the Trump administration’s imposition of new sanctions against Chinese importers of Iranian oil last week. The third round of high-level negotiations is set to take place next Saturday in Oman. Prices also decreased due to worries that the U.S.-led trade war could slow global economic growth and in turn reduce energy demand. Additionally, OPEC+ is expected to continue increasing its production by 411,000 barrels per day in May, although some of this increase could be offset by reductions from countries exceeding their quotas.

Brent crude oil futures rose to about $67 a barrel on Tuesday, likely a technical rebound after a drop of more than 2 percent in the previous session. However, the outlook remains bearish as progress in U.S.-Iran negotiations raises the likelihood of an agreement that could bring Iranian oil exports back to the market. Investors are also cautious amid economic headwinds from tariffs and increasing uncertainty regarding U.S. monetary policy, both of which are expected to impact the broader economy and potentially reduce oil demand. A recent survey indicates nearly a 50 percent chance of a U.S. economic recession within a year. Meanwhile, OPEC+ is still set to increase its production by 411,000 barrels per day in May, although some of that may be offset by countries cutting their quotas excessively.

Brent crude oil prices rose above $66 a barrel on Thursday, marking a second consecutive session of gains amid concerns about supply cuts stemming from new U.S. sanctions against Iran. Trump issued new sanctions on Wednesday against Iranian oil exports, including against a Chinese-based oil refinery, increasing pressure on Tehran amid ongoing nuclear negotiations. Fears of supply were further heightened after OPEC+ announced on Wednesday that it had received updated plans from Iraq, Kazakhstan, and other members to further reduce production to offset higher pumping above quota. However, OPEC, the International Energy Agency, Goldman Sachs, and JP Morgan lowered their forecasts for oil price and demand growth earlier this week amid escalating trade tensions. On the demand side, prices were supported by hopes for U.S.-China trade negotiations after China expressed openness to talks, provided certain key preconditions were met. For the week, prices have risen by more than 2%.

Telegram

Flip & Tap the link to join our Telegram Channel

Tap the link below

Flip & Tap the link to follow our channel

Tap the link below

Flip & Tap the link to directly contact our Managing Director

Tap the link below